advertisement

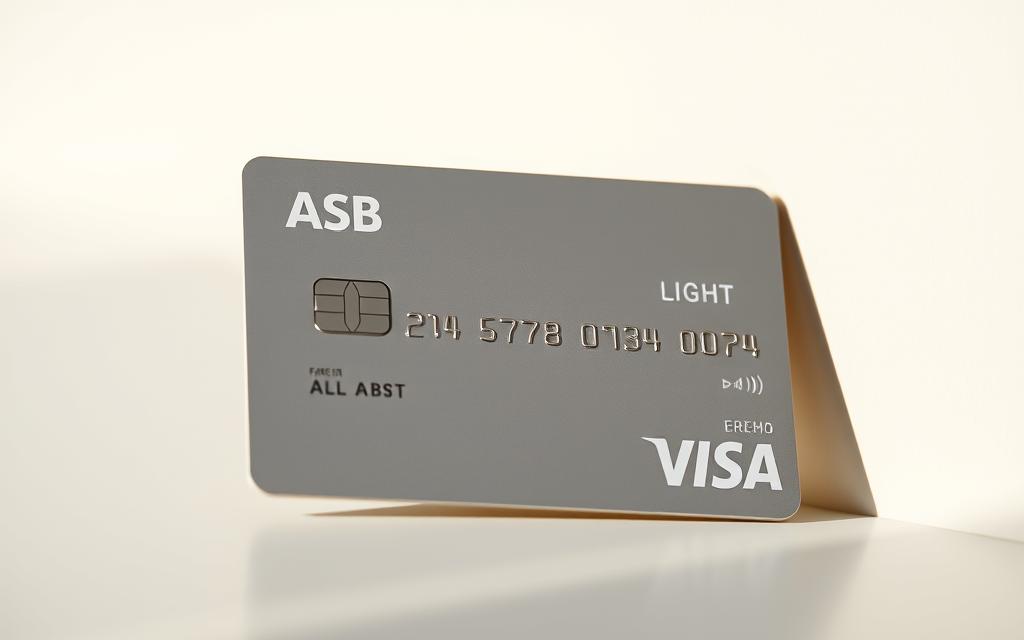

68% of Kiwis are looking for credit cards with lower interest rates. The ASB Visa Light offers financial flexibility for budget-conscious New Zealanders. It’s a smart choice for managing daily expenses efficiently.

ASB Visa Light

Tap and take the first step and find out how to apply for the card.

ASB Bank, a top Kiwi financial institution, understands modern consumers’ needs. Their Visa Light credit card is a practical solution with minimal financial burden. It caters to those seeking useful features without breaking the bank.

This credit card boasts transparency and affordability. It has a low annual fee, setting it apart from other banking products. Users can enjoy a simple financial tool that encourages responsible spending.

The ASB Visa Light also offers strong digital integration and security measures. It’s an attractive option for everyday transactions. Young professionals, students, and savvy spenders will find it particularly useful.

With competitive interest rates and a user-friendly approach, it stands out in New Zealand’s credit card market. The ASB Visa Light is designed to help you manage your money wisely.

Understanding the ASB Visa Light Card Basics

The ASB Visa Light offers a simple solution for New Zealand consumers. It’s a low-interest credit card designed for practical financial management. This card provides flexibility without unnecessary complexity.

ASB: A Pillar of Trustworthy Banking

ASB is a reliable banking partner in New Zealand. They consistently deliver customer-focused financial products. The Visa Light card showcases their commitment to accessible and transparent banking solutions.

The Credit Card Landscape in New Zealand

Low-interest credit cards have evolved to meet changing consumer needs. Customers now want more value, lower fees, and increased flexibility. The ASB Visa Light addresses these demands with key features.

- Competitive 12.90% p.a. interest rate

- Flexible interest-free periods

- Option for supplementary cards

- No account maintenance fees

Core Benefits at a Glance

| Feature | Details |

|---|---|

| Interest Rate | 12.90% p.a. |

| Interest-Free Periods | Up to 55 days |

| Supplementary Cards | Available for family members |

| Annual Fee | $0 |

Financial flexibility doesn’t have to come with complicated terms or hidden costs.

The ASB Visa Light suits those who occasionally carry a balance. It offers a straightforward credit solution with practical features. The card provides interest-free periods and supplementary cards for effective household financial management.

ASB Visa Light Features

The ASB Visa Light card offers smart financial tools for modern Kiwi consumers. It provides flexibility and convenience, making expense management simpler and more efficient.

This credit card focuses on meeting the financial needs of New Zealanders. It comes with features that help users handle their money wisely.

Low Purchase Interest Rate

A key feature is the low 12.90% per annum purchase interest rate. This rate helps cardholders manage their spending more effectively.

It reduces the overall cost of borrowing. This makes it ideal for budget-conscious consumers.

- Competitive interest rate of 12.90% p.a.

- Helps reduce long-term borrowing costs

- Ideal for budget-conscious consumers

Interest-Free Period Benefits

The card offers up to 55 days interest-free on purchases. This gives cardholders significant financial breathing room.

Users can make purchases and manage their cash flow with greater flexibility. It also helps reduce overall credit card costs.

- Up to 55 days interest-free on purchases

- Opportunity to manage monthly expenses

- Reduces overall credit card costs

Contactless Payment Capabilities

The ASB Visa Light embraces modern payment technologies. It offers seamless contactless payment options through Visa payWave.

This feature enables quick and secure transactions. It makes shopping and everyday purchases more convenient than ever.

- Visa payWave technology

- Rapid and secure contactless payment

- Simplifies everyday purchasing

Experience the convenience of modern banking with ASB Visa Light’s cutting-edge payment solutions.

Cost-Effective Banking with Zero Annual Fees

Choosing a credit card can be tricky for students and young professionals. The ASB Visa Light offers an affordable solution with its low annual fee approach.

The ASB Visa Light removes ongoing account fees. This is great news for those who want a simple, cost-effective credit card.

- No annual fee for the primary cardholder

- Zero hidden charges

- Transparent cost structure

This card makes budget management much easier. It removes the low annual fee barrier. Young professionals and students can now use credit without extra financial worry.

Smart banking isn’t about spending more—it’s about spending wisely.

The ASB Visa Light is a smart choice compared to cards with high annual fees. It saves you money over time. This makes it perfect for those starting their credit journey.

A good credit card is more than just a high credit limit. It’s a financial partner that understands your money needs and goals.

Smart Security and Digital Integration

The ASB Visa Light card offers top-notch digital protection for modern banking. It ensures customers can manage their finances with confidence. Advanced fraud protection mechanisms are at the heart of its design.

Advanced Fraud Protection Measures

ASB prioritises safeguarding cardholders’ financial information. Their multi-layered security strategy includes:

- Real-time transaction monitoring

- Instant alert systems for suspicious activities

- Sophisticated encryption technologies

- Immediate card suspension capabilities

Mobile Banking App Integration

The ASB Mobile app revolutionises how customers use contactless payments. Users can easily track spending and manage card settings. They also receive instant notifications about account activities.

| Feature | Benefit |

|---|---|

| Spending Tracking | Detailed transaction history |

| Card Management | Instant control over card settings |

| Security Controls | Real-time card blocking/unblocking |

Digital Wallet Compatibility

The ASB Visa Light card works smoothly with popular digital wallets. This enables convenient contactless payment across multiple platforms. Customers can link their card to Apple Pay, Google Pay, and Samsung Pay.

Conclusion

The ASB Visa Light is a clever financial tool for Kiwis wanting a simple credit card. It offers standout features that help budget-conscious people manage their monthly spending effectively.

Interest-free periods give cardholders a big advantage in controlling their finances. The low ongoing interest rate helps users keep their credit expenses in check.

This card suits those who prioritise fiscal responsibility over travel perks or rewards programmes. Its strength lies in simplicity and cost-effectiveness.

The ASB Visa Light has no annual fees and integrates well with digital banking. This makes it a smart choice for everyday transactions and careful money management.

It’s a practical credit solution for New Zealanders who prefer straightforward banking products. The card offers a no-frills approach to credit management with solid digital security.